There are moments in life when we slow down and reflect on where we’ve been, where we are – and where we’re headed. Sometimes this is at the start of a new year, or perhaps it’s at a significant milestone in life when we feel like we’ve crested a hill and can take a rest and enjoy the view.

At this point, as we identify things we’d like to change and things we’d like to amplify in our lives, we set intentions and goals and share our dreams. When it comes to financial planning, it’s vital that we set our intentions with integrity and authentic values, not superficiality and disconnected values.

There’s a quote by Kevin Heath that goes like this: “In the end, kids won’t remember that fancy toy or game you bought them; they will remember the time you spent with them.”

As you read this and reflect on your own childhood, and perhaps your parenthood, it’s easier to remember the moments – not the monetary value – that defined us and motivate our choices today.

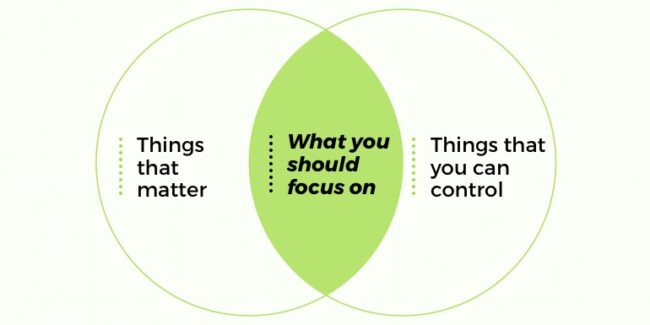

Yes, we can remember times of financial hardship or prosperity, and we can often remember big-ticket purchases, but it’s not always about the money spent, but what the money meant. This topic keeps coming up in our reformed thinking around financial planning: it’s not about how much money we have but how much we can achieve with our money. The two are linked, for sure, but where we place our focus will determine where we find our value.

When money is tight, it’s an opportunity for us to draw together and find creative ways to achieve our goals and dreams with the resources we have. And, when money is plenty, we have an equally challenging responsibility to invest or spend it wisely in ways that will have lasting value.

Ultimately, it’s about deeper relationships, not deeper pockets. As Charles Dickens wrote in his Christmas Carol, there is nothing in the world so irresistibly contagious as laughter and good humour. Wherever you are in your planning and reflection, may you be encouraged to focus on what you can achieve rather than what you can earn.