Information is at our fingertips, and artificial intelligence continually surpasses human capabilities in specific tasks; the landscape of valuable skills is evolving.

According to Dr Susan David, while technical know-how remains crucial, it’s quickly becoming commoditised. As a result, the pendulum is swinging towards the intrinsic value of distinctly human skills, finding and forging moments that connect us – one human to another.

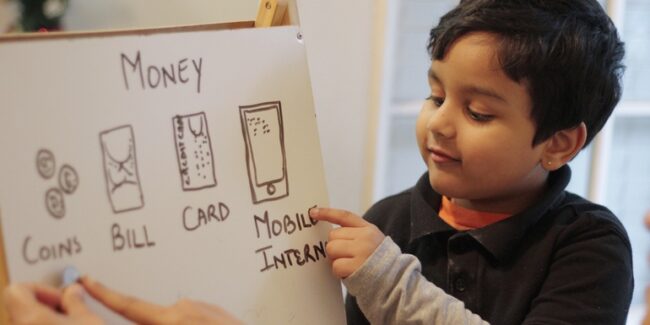

Think about it. Two decades ago, coding or data analytics knowledge might have been a rare and coveted asset. Today, there are countless online resources, courses, and platforms that can turn anyone into a proficient coder or data analyst. But while machines can execute commands, analyse vast datasets, or even create art, they can’t truly understand or replicate human emotions and psychological nuances—at least not in the genuine, empathetic way humans do.

Through all the noise and chaos, it’s our shared human moments that resonate the loudest.

The undeniable power of human connection lies between the marvels of technology and the intricacies of integrated financial planning. Financial decisions, after all, are deeply personal, often tied to our dreams, fears, and life stories. It’s in understanding these narratives that we can genuinely tailor strategies to individual needs. By marrying technical expertise with deeper emotional insight, integrated financial planning transforms from a purely transactional exercise to a journey of understanding, trust, and shared ambition.

With this in mind, what human skills promise to be the gold standard of the future?

- Emotional Agility

In a volatile, uncertain, complex, and ambiguous world, navigating our emotions (being agile in our responses and understanding the underlying reasons for our feelings) becomes paramount. Emotional agility is about being anchored amidst life’s storms, allowing us to respond to challenges with clarity and intention.

- Perspective-Taking

This is more than just seeing things from another’s viewpoint. It involves deeply understanding and appreciating different backgrounds, experiences and thought processes. This skill will be crucial for collaboration and innovation as workplaces become more diverse.

- Curiosity

This isn’t about the technical “how-to” questions but the “why” and “what if” inquiries that drive innovation. It’s the kind of curiosity that inspires us to look beyond the obvious, challenge norms, and seek more profound understanding.

- Empathy

Machines can recognise faces but can’t authentically “feel” for someone. Empathy allows us to connect, to understand, and to build heartfelt relationships. Empathy can bridge divides and foster true connection in a world where loneliness has been dubbed an epidemic.

- Connecting with purpose and values

Purpose drives motivation. It’s what gets us out of bed in the morning and fuels our passion. Machines operate on commands; humans operate on purpose. Connecting with that deeper “why” can inspire teams, drive missions, and propel businesses to new heights.

- Letting go to enable learning and evolution

This might be the most challenging. We, as humans, tend to cling to our beliefs, our routines, and our comfort zones. But true growth? It comes from letting go. From acknowledging that we don’t have all the answers and embracing the continuous journey of learning.

As Dr. David aptly points out, these human skills will be the driving forces behind well-being, economic mobility, and workplace success in the years to come. It’s a refreshing reminder, isn’t it?

In a world where technology seems to dominate every conversation, our inherent human traits will determine our trajectory. Because while algorithms and codes might power machines, emotions, values, and connections truly power us.