Have you ever gone down the #Fintwit rabbit hole? According to fintwit.ai, #Fintwit is a vibrant community of investors on Twitter, who tweet trading ideas, active trades, personal portfolios and well thought out insights about financial securities. Millions of investors around the world are increasingly using Twitter to stay abreast of the financial market and make informed investment decisions.

This financially savvy community is almost as popular as the #BTC (bitcoin) and #crypto communities who are determined to be the next billionaires from investing in cryptocurrencies. They create boundless content on how to best the systems and one could easily spend days scrolling through all of the tweets.

The challenge with these strongly supported content-creating communities is that they have enormous influence and create the perception that investment planning and management is the main (or only) focus of financial planning. The reality is that investing is just one area of about six.

Financial planning is more about managing behaviour than managing money. This is why the first area is cash flow management.

CASH FLOW MANAGEMENT

Some people refer to this as budgeting or a spending tracker. Ultimately, the goal is to have an enlightened conversation about where your money is going every month. Once we know that, we can plan how we can protect your assets and grow your assets.

RISK MANAGEMENT & PLANNING

From a financial perspective, we typically look at the different assets that need protecting; from your personal health to your income, accumulated savings and investments, this is a list that will keep changing throughout your life. Risk planning falls into two categories – your short term and long term risks.

INVESTMENT PLANNING

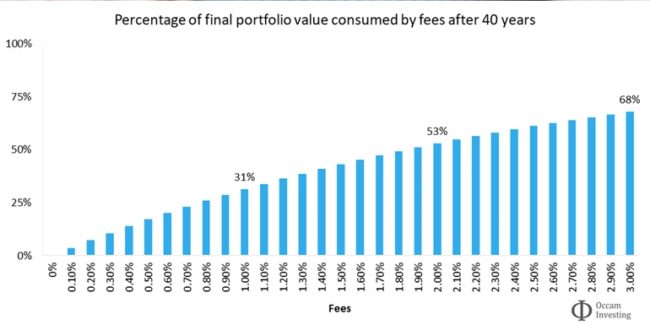

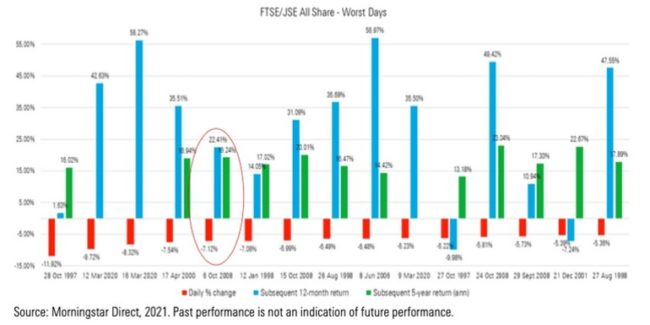

Your accumulated savings are great for emergency funds and rainy-day savings, but for long term growth with the benefit of serious compounding interest, we need to plan on how you invest your wealth. This is all about growing your wealth and allowing your money to work for you. This is where the #Fintwit bunch are always abuzz with ideas – but at the end of the day, you need a person who you can trust and lean on to keep you committed to your investment plan.

TAX PLANNING STRATEGIES

As your wealth grows, your tax liabilities will increase. Optimising your portfolio becomes a necessary discussion in order to reduce the amount of money you will have to pay to The Man. There are loads of strategies to legally protect and grow your wealth without eroding it to tax.

RETIREMENT PLANNING

In a nutshell – this is a sum of money that will help you rely less on income generation later in life. It doesn’t mean you have to stop working, or stop adding value – it just means that you are working to create more freedom for yourself so that you don’t have to work every day in order to pay your monthly bills and finance the lifestyle that you’d like to live.

ESTATE PLANNING

All of this asset building, combined with your risk portfolio, creates value in your personal estate. It doesn’t have to be millions; whatever you’ve built will be taxed when you pass away. To plan for this and reduce that tax liability and associated fees, estate planning ensures that your loved ones will have access to most of what you’ve been able to provide for them.

These are the most common areas of financial planning: cash flow management, risk management, investment planning, taxing planning, retirement and estate planning. They create the starting blocks for our conversations to help you manage your behaviour to ultimately manage your money better.