“We cannot change what we are not aware of, and once we are aware, we cannot help but change.” – Sheryl Sandberg

The foundation of most of our ongoing frustrations can be traced back to our habits, and the challenge with habits is we often aren’t even aware of them. When the world went into COVID lockdown, there was an increased awareness of face-touching, hand-washing and social distancing.

All of a sudden, we became aware that we could be touching our faces as much as three times every minute. We became aware of how close we would stand to people and how long we would wash our hands. This awareness, and knowledge of the implications, caused us to interrupt our regular routines and habits and change our behaviour.

Imagine how powerfully we could impact other areas in our lives where we feel stuck and frustrated with limited thinking and unhealthy habits!

When we constantly feel guilty for the money we have or regularly feel the stress of not having enough, we can start to recognise the habits accompanying those feelings. We might habitually be grumpy with loved ones because of finances or spend everything we have the minute it arrives in our account.

Recognising these patterns is the first step to connecting the habit to a desired or undesirable outcome – and we can interrupt that pattern. Even if we simply pause and take a mental note of what we’re doing, we’re already starting to alter our behaviour. Think about the first weeks of the global pandemic; there was so much happening that we would often forget our masks at home and would have to figure out how to work around it. Some of us kept spares in the car, our handbags and desk drawers.

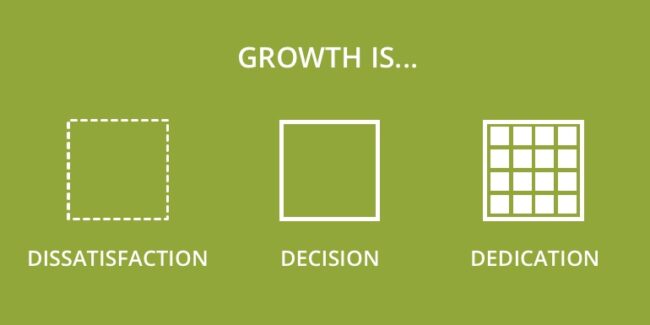

We didn’t change overnight, but our habits and thinking patterns were interrupted enough to slowly spark the change.

If you’re sitting with some blindspots and can’t see the roots of some of your habits, perhaps we could connect and chat through your frustrations. We can’t see our own blindspots, and when we’re unaware of them, we cannot change them. Having a financial adviser or coach work with you can help you recognise, interrupt and change the habits that keep you in an unhealthy space.