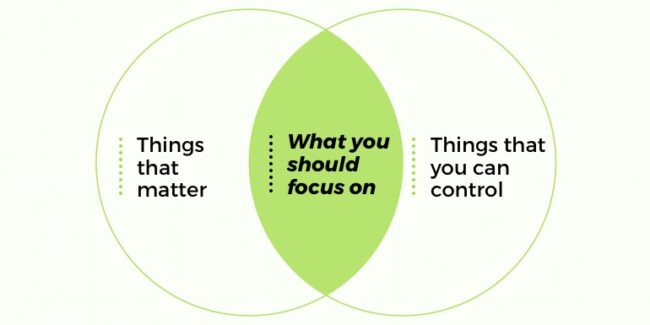

When life gets full and busy, it’s hard to remember why we do what we do, and it’s easy to become unhealthily disconnected from who and what we value. As Dr Susan David often says, finding your “why” can be as simple as reconnecting with your values and reframing your everyday activities in relation to those values.

This is not so easy when we’re under pressure to perform and meet the expectations that have been placed on us. But, if we’re cognisant of it, we can learn to be more intentional about seeking out our values, even when feeling the squeeze. This is how we can find and remain connected to our purpose and meaning in life.

As Dr David puts it – perhaps you’re dreading a particular meeting with a client with whom you just don’t see eye to eye. But when you remind yourself of the values you want to bring to work—such as clear communication and collaboration—you begin to evaluate this tricky relationship through a lens of possibility instead of struggle.

It’s not always as tepid as this, sometimes it’s red-hot volatility or significant change that we need to confront in order to find our peace. Engaging with our deeper values may call upon deeper disruption – like leaving a dead-end relationship or choosing to move to a different country.

The challenging reality is that if we don’t, at some point, try to engage deeply with our motivational values, no amount of money, status, property or relationships will give us the value that we’re desperately seeking. So, whatever it means to you, find it.

Dr David says that walking our why is a surefire way to cut through life’s messy and confusing meanderings to connect with who we really are. We cannot find our meaning at the end of an investment strategy or career path. All of those have little meaning, and equate to ‘just stuff’, if we don’t know who we intrinsically are at heart.

It is helpful to think about choices not as better or worse but as equal and different and to remember that values are related to quality over quantity. Consumerism puts blinkers on us and keeps us constantly ‘busy’ – so practice social snacking and find opportunities to enhance relationships when life gets busy. For example, prioritise phone calls and coffee dates!

Show up to yourself with courage, curiosity, and self-compassion. This is where we begin to experience authentic, deep, long-lasting value, which we can then lean on to guide our choices.