In a few recent blogs, we’ve considered our money stories and how we can not only route out false narratives but work towards creating new financial stories.

After exploring the emotional aspects of your financial health and understanding your money story, it’s time to create a new financial narrative that fosters a healthy money mindset. By actively working on your relationship with money and adopting positive habits, you can cultivate an empowering and emotionally balanced approach to your finances.

1. Mindful Spending: Begin by practising mindful spending, which involves being fully aware of your financial decisions and their consequences. Before making a purchase, ask yourself if it aligns with your values and long-term goals. By being intentional about your spending, you can create a healthier emotional connection with money and make choices that better serve your overall financial well-being.

2. Gratitude and Abundance: Cultivating a mindset of gratitude and abundance can have a transformative impact on your financial life. Focus on the blessings you already have and appreciate the value they bring to your life. This shift in perspective can help you break free from scarcity-driven choices and embrace a more positive outlook on your finances.

3. Setting Realistic Financial Goals: Develop a set of achievable financial goals that align with your values and priorities. By setting realistic targets, you can work towards your financial aspirations with a sense of purpose and motivation. Remember to celebrate small milestones along the way, as this can help reinforce positive behaviours and maintain your momentum.

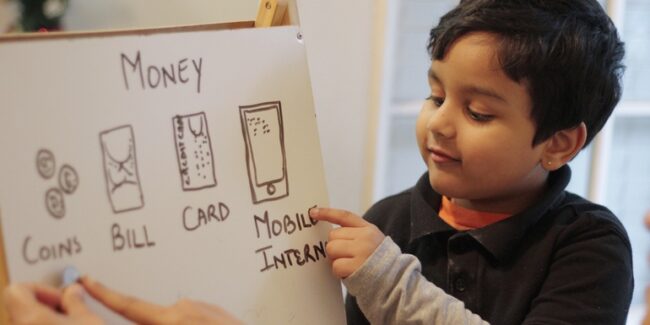

4. Seeking Support and Education: Building a healthy money mindset often involves seeking support and education from reliable sources. This can include reading books, attending workshops, or working more closely with our team. Surround yourself with people who inspire and encourage your financial growth, and be open to learning from their experiences and insights.

5. Establishing Healthy Money Habits: Make a conscious effort to develop healthy money habits that support your new financial narrative. This can include creating and sticking to a budget, setting aside an emergency fund, and consistently saving for your long-term goals. As you implement these habits, be patient with yourself – change takes time and effort!

6. Embracing Financial Self-Care: Just as you would for your physical and mental well-being, it’s crucial to practice financial self-care. This involves regularly checking in with your finances, addressing any concerns or challenges, and celebrating your progress. By taking care of your financial health, you can create a more balanced and fulfilling relationship with money.

7. Practicing Forgiveness and Compassion: Lastly, remember to extend forgiveness and compassion towards yourself as you embark on this journey of financial transformation. We all make mistakes and have areas where we can grow. Embrace your financial journey with kindness and self-compassion, knowing that you are continuously evolving and learning.

Creating a new financial narrative requires intention, effort, and patience. As you work towards embracing a healthy money mindset, remember that it’s a journey, not a destination. By actively engaging with your finances and adopting empowering beliefs and habits, you can forge a new financial path that aligns with your values, goals, and aspirations.